If you held one or more National Penn deposit accounts and who were assessed an overdraft fee that did not actually overdraw the account, you may be eligible for a potential award from the National Penn Overdraft Class Action Lawsuit! According to the lawsuit, National Penn charged overdraft fees on debit transactions that actually did not overdraw the account. The bank allegedly assessed these fees based on the account’s available balance instead of the ledger balance. The ledger balance tends to be higher and would not result in as many overdraft fees. National Penn continues to deny allegations and maintains that there is nothing wrong with their overdraft fee policy but has agreed to settle the class action lawsuit in order to avoid the expense of ongoing litigation. If you’re eligible, submit a claim form by November 7, 2017!

If you held one or more National Penn deposit accounts and who were assessed an overdraft fee that did not actually overdraw the account, you may be eligible for a potential award from the National Penn Overdraft Class Action Lawsuit! According to the lawsuit, National Penn charged overdraft fees on debit transactions that actually did not overdraw the account. The bank allegedly assessed these fees based on the account’s available balance instead of the ledger balance. The ledger balance tends to be higher and would not result in as many overdraft fees. National Penn continues to deny allegations and maintains that there is nothing wrong with their overdraft fee policy but has agreed to settle the class action lawsuit in order to avoid the expense of ongoing litigation. If you’re eligible, submit a claim form by November 7, 2017!

National Penn Overdraft CAL:

- National Penn Overdraft Claim Form

- Claim Form Deadline: 11/07/2017

- Who’s Eligible: Anyone in the United States who, from June 8, 2008 to Dec. 31, 2011, held one or more National Penn deposit accounts and who were assessed an overdraft fee related to a debit card transaction that left the account overdrawn based on the available balance but not based on the ledger balance.

- Estimated Amount: Varies

- Proof of Purchase: None Listed

- Case Name & Number: Collier v. National Penn Bank, et al., Case No. 12061036, in the Court of Common Pleas of Philadelphia County, Pennsylvania

How to File a Claim:

- Head on over to the National Penn Overdraft Claim Form.

- Read over the claim form to see if you are eligible.

- Complete the claim form with your info.

- Submit your claim form by November 7, 2017 to receive your potential award!

Bottom Line:

Individuals who were assessed an overdraft fee related to a debit card transaction that left the account overdrawn based on the available balance but not based on the ledger balance between June 8, 2008 to Dec. 31, 2011, may be eligible for a potential award from the National Penn Overdraft Class Action Lawsuit. According to the lawsuit, National Penn had allegedly assessed the fees based on the available balance as opposed to the ledger balance. Which could make the system charge the accounts even though they might still have money inside. If you had a National Penn account and were charged an overdraft fee often and suspected you still had money in the account, simply file a claim for a potential award by November 7, 2017! Don’t forget to take a look at our full list of Class Action Lawsuit Settlements!

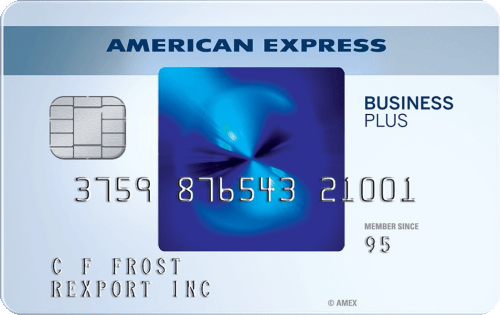

The Blue BusinessSM Plus Credit Card from American Express lets you earn 2 points for each dollar on everyday business purchases and up to $50k and 1 point per dollar thereafter. Simply use the points to reinvest in your business and reward your employees and clients. Choose rewards from over 500 leading brands in travel, gift cards, merchandise or entertainment. There is no annual fee. If you are a business owner who’s looking for the right business credit card, sign up for this excellent business rewards card from American Express. Terms apply. Apply Now---Amex Blue Business Plus Review The Blue BusinessSM Plus Credit Card from American Express lets you earn 2 points for each dollar on everyday business purchases and up to $50k and 1 point per dollar thereafter. Simply use the points to reinvest in your business and reward your employees and clients. Choose rewards from over 500 leading brands in travel, gift cards, merchandise or entertainment. There is no annual fee. If you are a business owner who’s looking for the right business credit card, sign up for this excellent business rewards card from American Express. Terms apply. Apply Now---Amex Blue Business Plus ReviewAmerican Express is an advertising partner of HustlerMoneyBlog. |